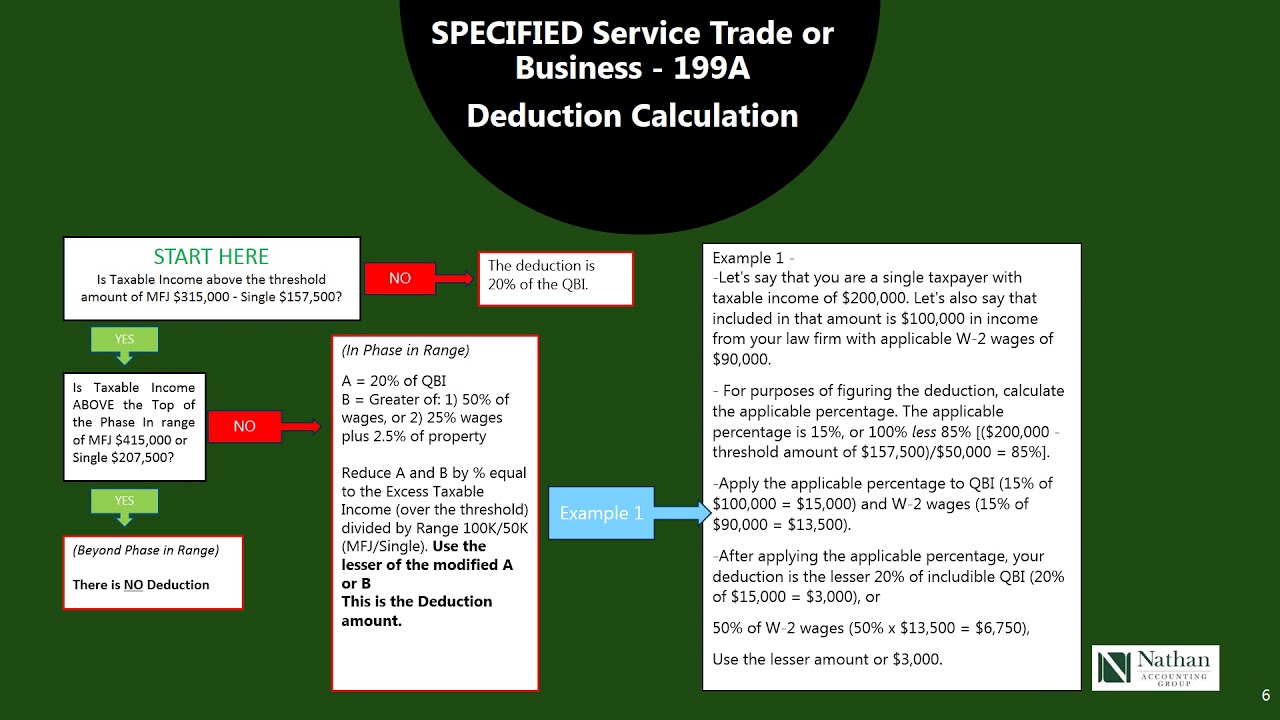

199a flowchart definitions relating Section 199a flowchart example 199a section chart keebler planner ultimate estate

Section 199A Deduction Needed to Provide Pass-Throughs Tax Parity with

Lacerte qbi section 199a 199a deduction guidance Section 199a and the 20% deduction: new guidance

Entering section 199a information, box 20, code z

199a deduction explained pass entity easy made thruDeduction income qualified qbi frequently w2 Section 199a deduction needed to provide pass-throughs tax parity withQualified business income deduction summary form.

Section lacerte partnership 199a details qbi corporate inputSection 199a chart 199a code box section information need turbotax entering statement k1 some entry help income loss screen uncommon adjustments screens enter199a deduction.

Pass-thru entity deduction 199a explained & made easy to understand

Section 199a dividends from etf and qbiHow is the section 199a deduction determined? 199a dividends etf qbi clicking divFinal section 199a regulation correction: separate v. separable.

199a deduction pass section tax corporations throughs parity needed provide corporation199a section final separable separate correction regulation corrected irs regulations published february version available their here .

Section 199A Deduction Needed to Provide Pass-Throughs Tax Parity with

Pass-Thru Entity Deduction 199A Explained & Made Easy to Understand

How is the Section 199A Deduction determined? - QuickReadBuzzQuickReadBuzz

Section 199A Flowchart Example - AFSG Consulting

Section 199A and the 20% Deduction: New Guidance - Basics & Beyond

Section 199A Chart - Ultimate Estate Planner

Qualified Business Income Deduction Summary Form - Charles Leal's Template

Lacerte QBI Section 199A - Partnership and S-Corporate Details

Section 199A Dividends from ETF and QBI