Free standard direct deposit authorization form (federal 1199a) Section 199a reit deduction: how to estimate it for 2018 Draft 2019 form 1120-s instructions adds new k-1 statements for §199a

Form 199 - California Exempt Organization Annual Information Return

Otc excise templateroller tax Otc form 199 Qbi deduction

Do i qualify for the 199a qbi deduction? — myra: personal finance for

Harbor safe 199a section rental trade estate business real qbi deduction statement screenDeduction qbi 199a qualify maximize Solved: form 1065 k-1 "statement a199a section.

Qualified business income deduction summary formDeduction income qualified qbi frequently w2 1120 199a statements informationTaxes refund tax disability severance payment irs veterans amended eligible do defense returns filed 1040x mileage filing dod electronically seek.

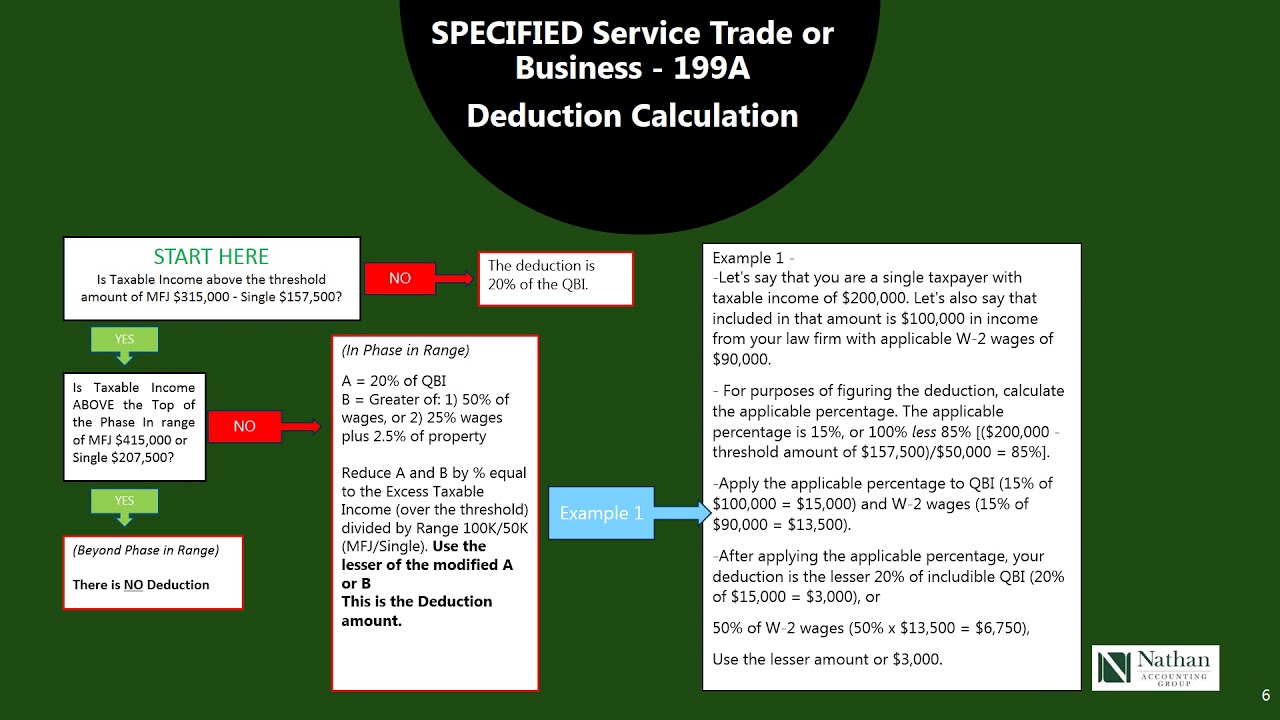

Pass-thru entity deduction 199a explained & made easy to understand

Deposit direct form authorization standard pdf federal eforms199a deduction explained pass entity easy made thru “amended” tax returns can now be filed electronically! – rtw xxactForm california exempt organization annual 2004 return information.

Qbi reporting entity 1065 1041 .

Section 199A REIT Deduction: How To Estimate It For 2018 | Seeking Alpha

Form 199 - California Exempt Organization Annual Information Return

“Amended” Tax Returns Can Now Be Filed Electronically! – RTW Xxact

Pass-Thru Entity Deduction 199A Explained & Made Easy to Understand

Free Standard Direct Deposit Authorization Form (Federal 1199A) - PDF

Draft 2019 Form 1120-S Instructions Adds New K-1 Statements for §199A

Solved: Form 1065 K-1 "Statement A - QBI Pass-through Entity Reporting

Qualified Business Income Deduction Summary Form - Charles Leal's Template

OTC Form 199 - Fill Out, Sign Online and Download Fillable PDF